By Kristan Reynolds, The Invading Sea

The following Q&A was conducted with Adrian Santiago, the CEO and co-founder of HighTide Intelligence. The company conducts flood risk assessments in Florida and the Carribean and provides solutions for managing flood risk. This interview has been edited for length and clarity.

How prevalent a problem is flooding today and in the future? What factors contribute to the severity and frequency of flooding?

Flooding is a severe issue in part because it’s a very expensive natural disaster, so it’s one of the most damaging hazards to property. Unlike other hazards — like heat — that are very threatening, flooding is very damaging to property. A lot of people’s homes and livelihoods are at risk, especially in coastal areas, but also in inland areas.

The severity and frequency of these events is exacerbated by climate change. Part of that is because we have a hotter ocean, so that leads to more powerful storms, more energy fueling these storms. Storm surge is becoming more severe, and we’re seeing more frequent extreme events and, also, more extreme rainfall events. …

Very slowly and in the background, almost imperceptible, is sea level rise — a baseline increase in flood risk is increasing at an accelerating rate. …

How does your AI powered flood risk engine work?

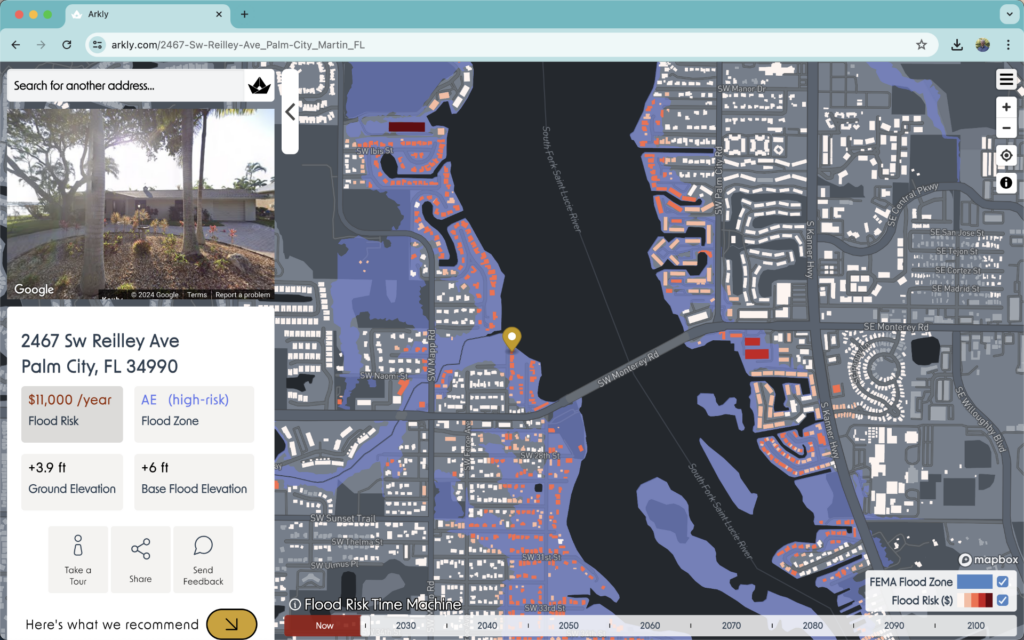

… Since flooding is a very expensive issue, we felt that a good place to start to help inform decisions was to put a dollar value on the risk. If people can understand how much money they could lose — how much money is at risk when it comes to flooding — then they’re going to be in a better position to make decisions about how to manage their flood risk.

The way our engine works is that we synthesize a lot of large data sets: The data sets about flooding itself, data sets about buildings and the exposed assets and how they respond to different flood depths. And then there’s a lot of nerdier stuff on top of that, but those are the basics. …

How do the tools that your company provides help the average person to understand their risk for flooding?

…We had all of this data from doing a statewide assessment for Florida, and then when Hurricane Ian hit, we had tens of thousands of people visit our website, and that data wasn’t accessible. So, we were frustrated that we had all the data and weren’t able to help. … That’s when we decided to open up our data sets to the public.

We launched Arkly, and the way Arkly helps people is that it provides the ability to search your home, learn about your flood risk and what it means in dollars, then compare the cost of your flood risk to solutions like insurance and mitigation. You can act on managing flood risk. By comparing the cost of flood risk to the cost of solutions, it’s a lot easier for people to make a decision because it’s informed by their own personal financial situation. …

What types of solutions does your organization provide for users facing flood risks, and how do you ensure the affordability of those solutions?

The two main solutions that we are currently working on are flood insurance and flood mitigation.

Flood insurance is a very practical, short-term solution. If it’s affordable, it’s probably the best way to go for a lot of people. In most cases, flood insurance is the easiest way that you can manage your flood risk.

We have partnered with a flood insurance agency called Rocket Flood. We integrated a quoting system into Arkly, so that any Arkly user can look at their flood risk in dollars and compare that directly to the cost of flood insurance, get the best quotes from the entire marketplace and then buy flood insurance. …

Mitigation is a more interesting solution — it’s also a lot more expensive. … It’s a longer-term solution. … You really have to look at the numbers to make sure that the cost benefit is there to make a decision of that magnitude. … Just to put it into context, it usually costs just about as much to elevate a building as the building may be worth.

For some people, if flood insurance is unaffordable and there’s no way they can get flood mitigation, the wisest decision may be to just sell and move somewhere else with lower risk. …

How does your organization work with local and state governments to assess, address and prevent flooding risks?

Right now, we are primarily involved with vulnerability assessments. These are assessments that municipalities and counties in Florida are doing in order to access state funds.

The focus of those assessments is primarily on locally owned assets, infrastructure, hospitals, emergency shelters — these kinds of assets, and making sure they’re resilient. … We also layer in the residential properties, and the people, the potential impacts to households, to add that layer of understanding and help communities really grasp the gravity of their situation. …

There are grant programs that we want to help local governments go after. … There are states that have been all over those grant programs and get a lot of the funding. Florida has struggled to scale flood mitigation compared to those states. …

Are there any new projects your organization is currently working on to continue addressing flood risks?

(We’re) very excited about getting Arkly out to other places: Other states and other nations, especially in the Caribbean, is our upcoming project. …

Let’s make it extremely easy for everyone to address their flood risk and continue living in the place they love, or continue living wherever they are without losing everything to flooding. My hope is that with Arkly … people have a better chance of not losing their livelihood, and if we can scale that up, then we can help a lot of people.

What is your message to the public?

To everyone out there who may or may not have flood risk that you know of, if you live in Florida or in Puerto Rico, go to Arkly.com and search your address and find your home and learn about your flood risk at this stage of the hurricane season. …

The best thing that anyone can do is get flood insurance, if you don’t have it. A lot of people are not aware that flooding is not covered by homeowners insurance — that’s a big part of the reason that so few people have flood insurance. …

(Arkly is now live) in Spanish, also, because there’s a big Spanish-speaking population living in Florida.

Kristan Reynolds is a Florida Atlantic University senior majoring in multimedia journalism and minoring in communication studies who is reporting for The Invading Sea during the summer 2024 semester.

Sign up for The Invading Sea newsletter by visiting here. If you are interested in submitting an opinion piece to The Invading Sea, email Editor Nathan Crabbe at ncrabbe@fau.edu. To learn more about storm surge, watch the video below.