This story was originally published by Grist. Sign up for Grist’s weekly newsletter here.

By Tik Root, Grist

From California to Florida, homeowners have been facing a new climate reality: Insurance companies don’t want to cover their properties. According to a recent report, the problem will only get worse.

The nonprofit climate research firm First Street Foundation found that, while about 6.8 million properties nationwide already rely on expensive public insurance programs, that’s only a fraction of 39 million across the country that face similar conditions.

“There’s this climate insurance bubble out there,” said Jeremy Porter, the head of climate implications at First Street and a contributor to the report. “And you can quantify it.”

Each state regulates its insurance market, and some limit how much companies can raise rates in a given year. In California, for example, anything more than a 7% hike requires a public hearing. According to First Street, such policies have meant premiums don’t always accurately reflect risk, especially as climate change exacerbates natural disasters.

This has led companies such as Allstate, State Farm, Nationwide and others to pull out of areas with a high threat of wildfire, floods and storms. In the Southern California city of San Bernardino, for example, non-renewals jumped 774% between 2015 and 2021. When that happens, homeowners often must enroll in a government-run insurance-of-last-resort program where premiums can cost thousands of dollars more per year.

“The report shows that actuarially sound pricing is going to make it unaffordable to live in certain places as climate impacts emerge,” said David Russell, a professor of insurance and finance at California State University Northridge. He did not contribute to the report. “It’s startling and it’s very well documented.”

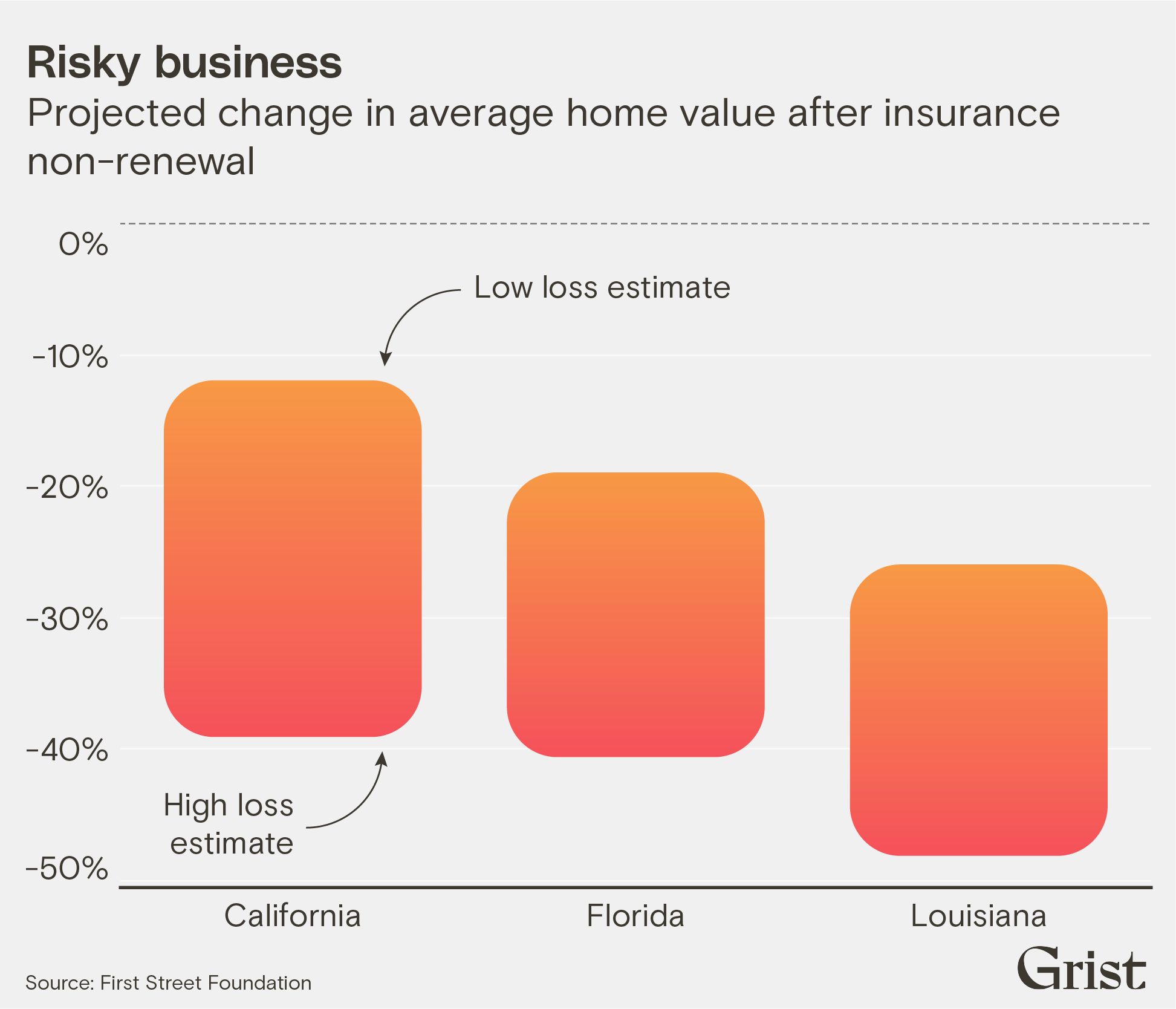

Russell says that what’s most likely to shock people is the economic toll on affected properties. When insurance costs soar, First Street shows, it severely undermines home values — and in some cases erodes them entirely.

The report found that insurance for the average California home could nearly quadruple if future risk is factored in, with those extra costs causing a roughly 39% drop in value. The situation is even worse in Florida and Louisiana, where flood insurance in Plaquemines Parish near New Orleans could go from $824 annually to $11,296 and a property could effectively become worthless.

“There’s no education to the public of what’s going on and where the risk is,” said Porter, explaining that most insurance models are proprietary. Even the Federal Emergency Management Agency doesn’t make its flood insurance pricing available to the public — homeowners must go through insurance brokers for a quote.

First Street is posting its report online, and it also runs riskfactor.com, where anyone can type in an address and receive user-friendly risk information for any property in the U.S. One metric the site provides is annualized damage for flood and wind risk. Porter said that if that number is higher than a homeowner’s current premiums, then a climate risk of some kind probably hasn’t yet been priced into the coverage.

“This would indicate that at some point this risk will get priced into their insurance costs,” he said, “and their cost of home ownership would increase along with that.”

Wildfires are the fastest growing natural disaster risk, First Street reported. Over the next 30 years, it estimates the number of acres burned will balloon from about 4 million acres per year to 9 million, and the number of structures destroyed is on track to double to 34,000 annually. Wildfires are also the predominant threat for 4.4 million of the 39 million properties that First Street identified as at risk of insurance upheaval.

“You don’t want someone to live in a place that always burns. They don’t belong there,” he said. “We’re subsidizing people to live in harm’s way.”

First Street hopes that highlighting the climate insurance bubble allows people to make better informed decisions. For homeowners, that may mean taking precautions against, say, wildfires, by replacing their roof or clearing flammable material from around their house. Policymakers, he said, could use the information to help at-risk communities adapt to or mitigate their risk. In either case, Porter said, reducing threats could help keep insurance rates from spiking.

Ultimately, though, Russell says moving people out of disaster-prone areas will likely be necessary.

“Large numbers of people will need to be relocated away from areas that will be uninsurable.” he said. “There is a reckoning on the horizon and it’s not pretty.”

This article originally appeared in Grist at https://grist.org/housing/climate-risks-place-39-million-homes-at-risk-of-losing-their-insurance/.

Grist is a nonprofit, independent media organization dedicated to telling stories of climate solutions and a just future. Learn more at Grist.org.

Sign up for The Invading Sea newsletter by visiting here. If you are interested in submitting an opinion piece to The Invading Sea, email Editor Nathan Crabbe at ncrabbe@fau.edu.