By Katie Carpenter, Everwild Media

With all the festivity of the holidays, you may not have noticed a recent distressing occurrence in your mailbox. While we were merrily distracted, tens of thousands of Florida homeowners received letters bumping them into high-risk flood zones.

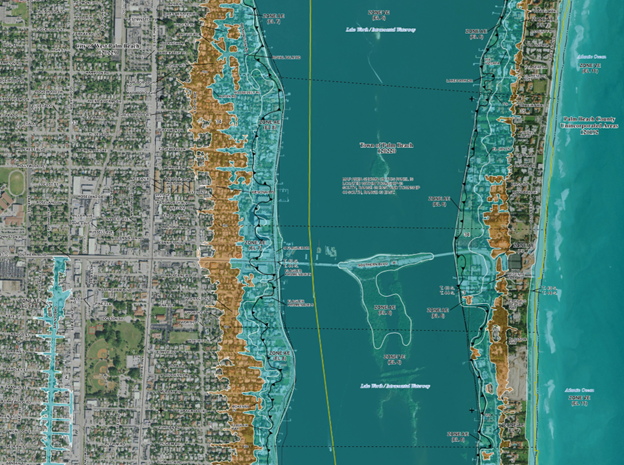

The Federal Emergency Management Agency (FEMA) released its widely anticipated new flood risk maps on Dec. 20, and unsuspecting residents learned that they may now be required to buy flood insurance. In Palm Beach County alone, more than 16,000 properties have been impacted. Many have been told they have an increase in required base flood elevation of 1 foot or more.

It’s like your house sank overnight, only it didn’t — it’s just the measuring stick that moved.

The anxiety has spread slowly across the state. In Miami-Dade County, more than 45,000 additional structures are now classified as high risk. Thousands more are in counties on the state’s hurricane-battered Southwest coast

You don’t need to know what the acronym of your new flood zone even means. If it’s an AE, AO, AH or VE zone, your letter warns that “mandatory flood insurance purchase requirements apply.”

Florida is considered the most flood-prone state in the U.S., closely followed by Texas, Louisiana and New Jersey. After hurricanes Helene and Milton broke flooding records last year, more homeowners are starting to pay attention, but not all.

Those who got through the hurricanes without much damage may still be chuckling at news photos of people paddleboarding to work. It isn’t until you have to rip out ruined carpet and soggy drywall, or throw away family pictures or children’s toys that fell under a table into muddy water, that you understand the sobering nature of the threat.

It’s not only heartbreaking, but expensive, too. Some homeowners could be looking at a new bill of several thousand dollars per year, or more. Many wonder why they have to buy flood insurance when they’re on a high floor in a condo building or miles inland, away from the coast.

Still more vexing: It is estimated that only about 13% of Floridians have flood insurance. “Flood risk is probably the fastest-growing risk in the country, and the least insured,” former FEMA head Craig Fugate told a University of Florida real estate research center.

Fugate lives in Florida and understands our pain. When asked by homeowners if they should buy flood insurance, he asks, “Do you live in Florida? If the answer is yes, then you’re in a flood zone” of one level or another.

“Compounding the problem is the increased frequency and intensity of storms driven by climate change,” said Jean-Luc Eckstein of Neptune Flood to the insurance website HoneyQuote.com. “Homeowners in areas that have never seen flooding before are experiencing water levels they never thought could happen at their property.”

Over at Mar-a-Lago, there may not be much talk about climate change. Yet the rest of us can’t ignore it. There’s no question sea level is rising and the water table is too.

Storm or no storm, many ask if there’s a way to prepare for an unexpected flooding event if you’re new to this hazard. You hear of options like home elevations, flood proofing, bolstering doors and windows, even installing a self-activating flood barrier. Some people raise their driveway or put flood vents in their garage.

If you’ve already experienced flooding, you may be eligible for a FEMA grant or low-interest disaster loan to make the improvements. That could take time, however, and you may need to move faster than that. If you feel like lobbying, you’ll have to get in line – things will get busy after Inauguration Day.

Talk about it with your neighbors, call your agent or try visiting the FEMA flood insurance site at www.floodsmart.gov to find out more. Turns out there are ways to change your flood zone designation with a LOMA – a Letter of Map Amendment – if you think you were mistakenly put into too hazardous a flood zone. There you can calculate your risk or chat with an expert, and learn there are things you can do to prepare.

There’s little doubt that if your town is getting wetter, your king tides and storm surges higher, and the rain more extreme, you should look into your options as soon as possible. Now is the time to start – hurricane season begins June 1.

Katie Carpenter is a West Palm Beach-based filmmaker with Everwild Media (www.everwildmedia.com), producing documentaries about conservation, climate change and solutions. Banner image: A flooded street following Hurricane Debby (iStock image).

Sign up for The Invading Sea newsletter by visiting here. To support The Invading Sea, click here to make a donation. If you are interested in submitting an opinion piece to The Invading Sea, email Editor Nathan Crabbe at ncrabbe@fau.edu. To learn more about flood zones, watch the video below.