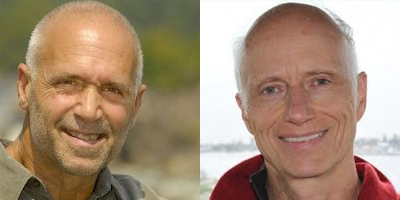

By Mike Italiano and Brian Davis, Capital Markets Partnership

Rising sea surface temperatures are the engine causing more intense and powerful hurricanes that are damaging Florida, including Milton, Helene and Ian.

These dangerous impacts of climate change are increasing an untenable $150 billion in estimated insurance payouts for climate disasters annually, forcing insurers to withdraw from many home insurance markets and greatly raise premiums.

Florida’s home insurance premiums are the nation’s highest, averaging more than $10,000 per year statewide and almost $17,000 per year in Miami, according to mortgage publications. The U.S. Senate Budget Committee has held 19 hearings on the mortgage and insurance crisis, with its chairman concluding, “This isn’t complicated. Climate risk makes things uninsurable. No insurance makes things unmortgageable. No mortgages crashes the property markets. Crashed property markets trash the economy.”

A leading expert on these issues, attorney and former California Insurance Commissioner Dave Jones, emphasized the root of the problem: “Due to the failure to substantially reduce greenhouse-gas emissions in the U.S. and globally, we are marching steadily to an uninsurable future.”

The federal Financial Stability Oversight Council has warned that climate change is an emerging threat to the financial stability of the U.S.

Twenty-eight annual United Nations climate change conferences have failed. Private sector financing needs to be rapidly deployed. As White House U.N. Special Climate Envoy John Kerry said in 2022, private sector leadership in the climate crisis is required because no government “has enough money to be able to solve this problem.”

The market recognizes that large-scale, rapid global funding is required. A senior partner at the consulting firm McKinsey & Co. told 100 climate financiers at a recent Climate Week NYC event to go big or go home: “It’s not just speed that we’re looking for. We need to intentionally seek greater and greater scale. We need to motivate ourselves to go faster and go bigger.”

The built environment offers the best opportunity to address climate change on a large scale. The buildings and construction sector is considered the largest emitter of greenhouse gases, responsible for nearly 40% of global emissions.

Green buildings are the world’s largest sustainability market, more than double the combined annual revenue of global wind, solar and electric vehicles. There are already hundreds of thousands of green buildings certified across the world, but there could be far more with increased private financing.

Such financing would provide green building owners with cheaper capital and higher appraised value. Insurers need this solution to continue to issue property insurance and stop the acceleration of payouts after climate-fueled natural disasters.

As hurricanes become even more intense and powerful, Florida’s buildings must be more resilient and efficient. Green buildings reduce greenhouse-gas emissions while also using more durable materials and construction methods that better withstand disasters.

Top insurers and developers are starting to recognize this solution, but more private sector financing is needed – quickly. The safety of Floridians and their ability to obtain insurance is at stake, as well as the viability of the property markets that are critical to U.S. financial stability.

Mike Italiano is CEO of the nonprofit Capital Markets Partnership and was co-founder and former general counsel of the U.S. Green Building Council. Brian Davis is an environmental attorney with more 40 years’ experience and executive vice president of Capital Markets Partnership (www.capitalmarketspartnership.com). For more information, click here.

If you are interested in submitting an opinion piece to The Invading Sea, email Editor Nathan Crabbe at ncrabbe@fau.edu. Sign up for The Invading Sea newsletter by visiting here. Banner image: A roofer at work (iStock image).